By Alexandra Banks

News of Jay-Z making a business deal with the NFL and rapper Nas and Will Smith investing in an app to teach teenagers financial literacy has once again sparked an age-old debate on whether black people are smart with their money.

You often hear in casual conversation or see on social media remarks about black people spending their money on the newest Jordans or latest NBA 2K video game. The theory behind those comments is that the black community is just generally financially illiterate and spends its dollars on frivolous purchases, thereby maintaining African Americans’ financial disadvantage in America.

So do black people spend all of their money on the latest iPhones and sneakers? Or is the concept of financial literacy being used to shame low-income black and brown communities for making what some would consider luxury purchases?

“I think financial literacy is an issue across the board,” says economist and Howard University professor Omari Swinton.

In a 2018 study conducted by the Financial Industry Regulatory Authority, over 25,000 American adults were surveyed on financial literacy. The FINRA found that of the five questions covering economic and financial topics such as interest rates, inflation, bonds, mortgages and risk, 66% were unable to answer more than three. Also, when questioned on credit card literacy, it was found that 56% did not properly research or compare rates among credit card providers before choosing one.

It seems as if the black community, if as financially illiterate as rumor has it, is a part of the mass of financially illiterate American adults.

“We are at a big disadvantage, but it is not anything that’s supposed to be unique to us, that we need to learn different from people who aren’t African Americans. We need to learn the same stuff but we are at a disadvantage,” says Dr. Debby Lindsey-Taliefero, an economist at Howard University.

However, let’s examine the actual spending habits of black American consumers.

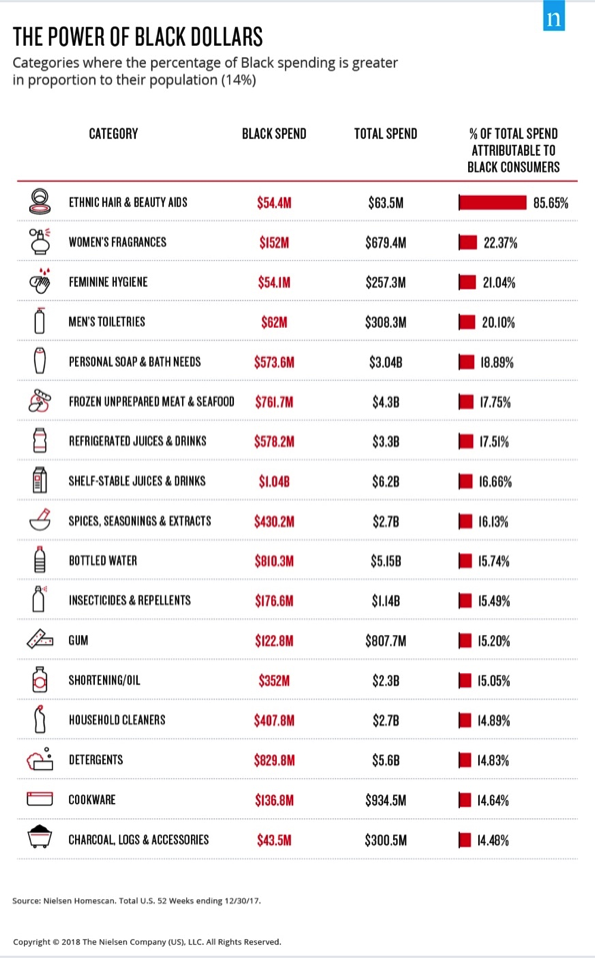

In a 2017 study conducted by Nielsen Holdings on the impact of black consumers, black spending in 16 categories examined was disproportionately greater than black people’s roughly 14% of the population in America.

So yes, black people proportionately spend more money than their share of the population but that does not prove they are more financially illiterate than other racial groups in America nor does it mean that the black community spends all of their money on meaningless purchases. Furthermore, according to the Sociology of Race and Ethnicity, when examining mean quarterly spending of black and white households between 2013 and 2014, blacks spend on average less than whites within the same socioeconomic class. Low-income “blacks spent $5,223 on average compared with $7,058 for low-income whites, middle-income blacks spent $9,113 (vs. $11,106 for whites), and top-income blacks spent $16,527 (vs. $21,075 for whites).” The data shows that on average, blacks are spending significantly less than their white counterparts, yet the black community’s “poor spending habits” still are being blamed for stark disparities in wealth.

Truth be told, financial literacy is a national problem affecting Americans across all racial groups and is not specific to blacks, whites, Asians or Latinos. It would be beneficial to all Americans to educate themselves on financial matters such as debt, borrowing, saving and investing.

So, if spending habits and lack of financial literacy aren’t the reason for blacks’ economic disadvantage in America, then what is?

“The racial wealth gap is because of historical things that have happened within the country, not because blacks don’t have financial literacy…increasing financial literacy is not going to be a remedy for closing the racial wealth gap,” Swinton says.

While financial literacy, which can be defined as possessing the set of skills and knowledge that allows an individual to make informed and effective decisions with all of their financial resources, is important to maintain wealth in a capitalistic society, institutionalized racism remains a factor in acquiring black wealth.

The racial wealth gap has only worsened since the 1980s, resulting in the median black wealth in 2016 amounting to $13,460—less than 10% of the median white wealth of $142,180, according to a Center for American Progress report. It is safe to say that the wealth gap is not due to the $54.5 million spent on ethnic haircare and beauty, but due to institutional and historic factors such as slavery, discrimination in mortgage lending and borrowing and other institutionalized economic disadvantages.

In addition to historic factors, current disparities in income among races and ongoing racism in employment and housing continue to foster the gap.

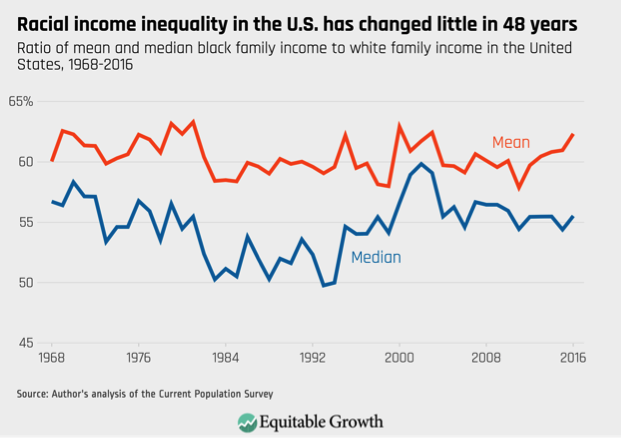

Income inequality has generally gotten worse for black Americans, which has caused the wealth gap to worsen as well. In fact, in 2016 the median income for black families was 56% of that of whites, a 1% decrease from what it was in 1968, according to one study.

So while financial literacy is an issue, it is not the driving force (or even close to it) in the disparities in racial wealth in America.